Your Roth IRA is just an account. Once you make a deposit into your Roth IRA, you need to invest in the stocks, ETFs or Mutual Funds you choose. Until then your money earns you nothing!

Here are the three steps to make your Roth work for you:

1. Decide an asset allocation

Target Date Funds have somewhat simplistic asset allocations, but the allocations change to reduce risk the closer you are to retirement, without any intervention on your part. If your retirement is say 30 years away in 2050, a target date fund might have an asset allocation something like this:

60% Domestic Equity

30% International Equity

7% Bonds

3% Money Market Fund or Cash Fund

With just a few years to retirement, say in 5 years, your allocation could change to:

30% Domestic Equity

15% International Equity

50% Bonds

5% Money Market Funds or Cash Funds

The advantage is that your allocation is automatically maintained and closer to retirement, the allocation gets tilted away from risky assets like equity and towards less risky assets like Bonds to minimize a huge drawdown just when you need the funds.

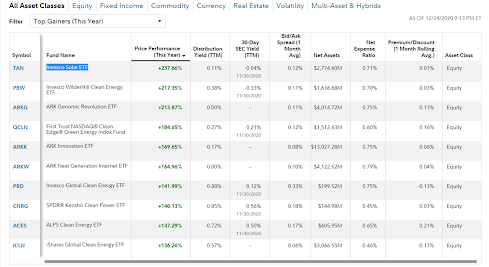

2. Decide which funds

3. Rebalance at least annually or whenever allocation is off by a set percentage.

4. Consider an allocation to crypto-currencies.

The information provided here is my take on finding the best investment options for me and for general informational purposes only and is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is necessary or appropriate, consult with a qualified tax advisor, CPA, financial planner or investment manager.