Fidelity or Vanguard?

See what Rose says:

Fidelity has a number of index mutual funds with zero expenses. How do they do that? With costs coming down, Fidelity absorbs the cost, hoping to sell you other services. Also by following an in-house index, they do not have to pay license fees to S&P or any other indexing service. Returns are also better because the stocks they own are 'lent' to other brokerages and earn additional passive income.

Pros:

- No minimums on the first purchase

- You can purchase fractions of the fund, you do not have to buy a full share

- You can automate your investment

Cons:

- The price at which you purchase the fund is not set until the close of market

With the zero expense funds, the difference between Mutual Funds and ETFs has just narrowed!

US Total Stock Market Funds/ETFs:

FZROX - Fidelity Total Stock Market Fund - Expense Ratio 0.0%

VTI - US Total Stock Market - Expense Ratio 0.03%

SP500 Funds/ETFs:

FNILX - Fidelity Zero Large Cap Index Fund - Expense Ratio 0.0%

FXIAX - Fidelity 500 Index Fund - Expense Ratio 0.04%

International Stock Market Funds/ETFs:

FZILX - Fidelity Zero International Index Fund - Expense Ratio 0.0%

VT - International Stock Market - Expense Ratio 0.05%

Growth Funds/ETFs:

QQQ - Invesco QQQ Trust tracks the Nasdaq - Expense ratio 0.2%

ARKK - Actively Managed -Technology ETF - Expense ratio 0.75%

TAN - Actively Managed - Invesco Solar ETF - Expense ratio 0.71%

PBW - Actively Managed - Invesco WilderHill Clean Energy ETF - Expense ratio 0.70%

ARKG - Actively Managed - Genomic Revolution ETF - Expense ratio 0.75%

Bond Funds/ETFs:

Dividend Funds:

NOBL - S&P500 Dividend Aristocrats 2.28% - Expense Ratio 0.35%

SCHD - Schwab's US Dividend ETF - Dividend Yield 3.44% - Expense Ratio 0.06%

VIG - Dividend Yield - Dividend Yield 1.81% with Growth - Expense Ratio 0.06%

VYM - High Dividend Yield 3.5% - Expense Ratio 0.06%

SPHD - Dividend Yield 5.5% - Expense Ratio 0.3%

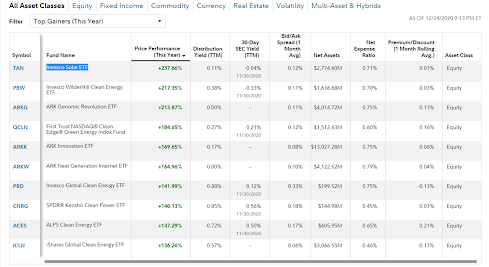

Check out the ETF screener at the Fidelity ETF Research Center. Here is a sample of what you can expect to see:

Data from public sources, prices and data may have changed. Please reconfirm before committing any funds or making any investment plans. Copyrights and attributions as mentioned.

The information provided here is my take on finding the best investment options for me and for general informational purposes only and is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is necessary or appropriate, consult with a qualified tax advisor, CPA, financial planner or investment manager.

No comments:

Post a Comment